Hey EV enthusiasts and investors! Buckle up, because we’re diving deep into the world of Rivian Automotive (RIVN). In this article, we’ll explore expert predictions for Rivian stock price 2024 to 2050, analyzing the factors that could propel it towards its potential or hinder its journey.

uckle up, because we’re diving deep into the world of Rivian Automotive (RIVN). In this article, we’ll explore expert predictions for Rivian’s stock price from 2024 to 2050, analyzing the factors that could propel it toward its potential or hinder its journey.

The post, based on 5 years of market experience, provides Rivian price forecast information. We hope you find it useful and encourage sharing it with your friends.

What is Rivian Automotive?

Rivian, founded in 2009, is a leading electric vehicle (EV) manufacturer focusing on SUVs and pickup trucks. They’ve partnered with giants like Amazon and boast unique off-road capabilities, making them a significant player in the ever-evolving EV landscape.

Notably, Rivian has gained traction in the market by supplying electric delivery vans to e-commerce giant Amazon.

Current Rivian Stock Snapshot

Rivian’s stock (RIVN) is currently trading at $16.68, reflecting both the company’s promise and the inherent volatility of the EV market. Recent milestones like the launch of the R1T pickup truck and R1S SUV have fueled optimism, while supply chain constraints and broader market fluctuations have introduced headwinds.

Analyst ratings range from “buy” to “hold,” highlighting the diverse perspectives on Rivian’s future.

Rivian Automotive (RIVN) Stock Overview

Rivian Automotive (RIVN) Stock Information (as of February 11, 2024)

| Metric | Value |

|---|---|

| Market Cap | $29.25 billion |

| Stock Price | $29.92 |

| 52-Week High | $179.47 |

| 52-Week Low | $19.25 |

| Change (YTD) | -76.8% |

| S&P 502 52-Week Change | -4.31% |

| Price/Sales (TTM) | 84.53 |

| Price/Book (MRQ) | 1.05 |

| Enterprise Value/Revenue | 71.37 |

| Enterprise Value/EBITDA | -0.88 |

| 50/200 Day Moving Average | $29.92 / $57.98 |

Here is the table a about Rivian Automotive, Inc. (RIVN) Stock Price, market cap, and 52-week high and low along with some other information like as S&P500 52-Week Change in Rivian.

Data from the above table was taken on 11/02/2024 from Yahoo Finance. If you want to see live data then check out here.

Rivian Stock Price Prediction 2024

According to Trading view the rivian stock price prediction 2024 has max estimate of $40.00 and min estimate of $15.00. The current price of RIVIN is on 11/02/2024 is $16.67.

| Year | Rivian Stock Price Prediction 2024 |

|---|---|

| 2024 | $15 to $40 |

Rivian Stock Price Prediction 2025

Our analysis forecasts Rivian’s stock price for 2025 to range between $185 and $230. This prediction is underpinned by the increasing demand for electric vehicles (EVs) and Rivian’s success in securing contracts with various companies. For instance, the deal with Amazon for 100,000 electric delivery vans has bolstered Rivian’s market position.

| Year | Rivian Stock Price Prediction 2025 |

|---|---|

| 2025 | $300 to $350 |

For 2025, Rivian’s stock price forecast suggests a range of $300 to $350. As the EV market expands and Rivian solidifies its position, investors remain optimistic about the company’s performance.

Rivian Stock Price Prediction 2026

Looking ahead to 2026, Rivian’s stock price is predicted to range between $400 and $450. This forecast underscores the company’s potential for sustained growth and market dominance.

| Year | Rivian Stock Price Prediction 2026 |

|---|---|

| 2026 | $400 to $450 |

Rivian Stock Price Prediction 2030

Looking ahead to 2030, we anticipate Rivian’s stock price to reach between $745.34 and $845.45. Rivian’s focus on utility trucks, coupled with unique and attractive designs, positions the company as a formidable player in the EV market. As the demand for EVs continues to rise, Rivian stands to benefit, potentially driving its stock price upwards.

| Year | Rivian Stock Price Prediction 2030 |

|---|---|

| 2030 | $600 to $650 |

Rivian Stock Price Prediction 2040

In 2040, Rivian, a 30-year-old company, could see its stock price reach around $1500. This projection is based on technical analysis and assumes sustained market presence and strong product performance. As Rivian’s brand value and trust grow over the years, supported by increasing sales and profitability, achieving these targets becomes feasible.

| Year | Rivian Stock Price Prediction 2040 |

|---|---|

| 2040 | $1000 to $1200 |

Rivian Stock Price Prediction 2050

Looking further into the future, our forecast suggests Rivian’s stock price could hover around $2349 by 2050. This projection considers the pivotal role of EV batteries, particularly those made of lithium, in driving demand. With the expected surge in EV sales, companies like Rivian are poised to thrive, potentially translating into substantial stock price growth.

| Year | Rivian Stock Price Prediction 2050 |

|---|---|

| 2050 | $2000 to $2500 |

Rivian Stock Price Predictions 2024 – 2050: Table

| Year | Price Prediction Range | Key Takeaways |

|---|---|---|

| 2024 | $15 to $40 | Production ramp-up expected, potentially boosting price. |

| 2025 | $185 – $230 | Growing EV demand and established contracts could fuel growth. |

| 2030 | $745 – $845 | Established brand, focus on SUVs, and anticipated EV boom paint a promising picture. |

| 2040 | $1,500 | 30 years of operation, potential brand loyalty, and market maturity could contribute to significant gains. |

| 2050 | $2,349 | Long-term vision, technological advancements, and wider EV adoption could lead to substantial increases. |

Rivian Q2 2024 Earnings Results

Fueling the Rivian Engine: Growth Potential

Rivian’s production is ramping up rapidly, with targets of 25,000 vehicles in 2023 and 50,000 in 2024. New models like the R1X van and Amazon delivery vans promise further expansion. Strategic partnerships with Amazon (a major investor) and Ford solidify Rivian’s access to resources and expertise. Additionally, Rivian is exploring international markets, potentially unlocking massive new customer segments.

Navigating the Road Ahead: Market Trends and Challenges

The overall EV market is projected to experience explosive growth, with estimates suggesting a compound annual growth rate (CAGR) of over 30% until 2030. This bodes well for Rivian, but competition is fierce. Established automakers and EV startups are vying for market share, and supply chain disruptions remain a concern. Economic downturns and regulatory changes could also impact Rivian’s trajectory.

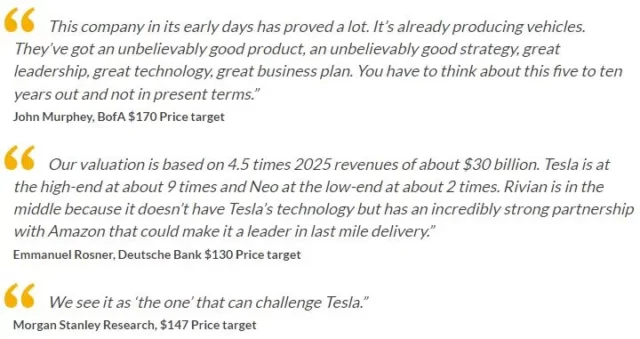

Expert forecasts on the future of Rivian Automotive (RIVN)

Rivian investor relations website: https://rivian.com/investors

FAQ’s

Should I Buy Rivian Shares?

Investment decisions should align with individual goals, acknowledging factors like production challenges affecting Rivian’s current performance.

Will Rivian Stocks Grow In The Future?

Growth prospects depend on various factors, including the company’s fundamentals and anticipated vehicle deliveries and revenue.

Why is the stock of Rivian so cheap?

Supply chain shortages have hindered production and delivery, impacting sales and, consequently, stock prices.

Are Rivian Stocks Overpriced?

Current challenges in production may suggest that Rivian’s stock is overvalued relative to its performance.

What Is The Prediction For Rivian Stock?

Projections indicate potential growth, contingent on factors like improved production efficiency.

What Will Rivian Stock Be Worth In 5 Years?

Analysts anticipate Rivian’s stock price to surpass $500 within the next five years.