Taking out federal student loans can be a daunting experience. Amidst the excitement of pursuing your education, it’s crucial to understand your rights and responsibilities as a borrower. This knowledge empowers you to manage your loans effectively, avoid potential pitfalls, and ultimately achieve your financial goals.

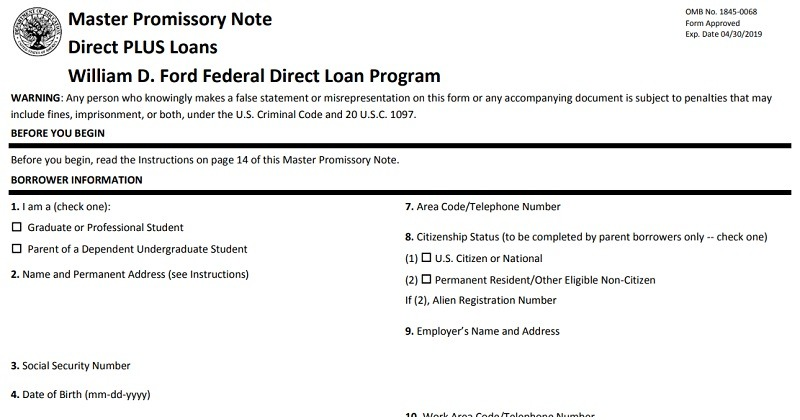

Your Essential Guide: The Master Promissory Note (MPN)

The cornerstone of your federal student loan journey lies in the Master Promissory Note (MPN). This legally binding document outlines the terms and conditions of your loan, serving as a roadmap for repayment. It spells out:

- Loan details: repayment period, interest rates, origination fees, and any applicable charges.

- Your rights: Options for deferment, forbearance, income-driven repayment plans, and potential loan forgiveness programs.

- Your responsibilities: Consistent repayment, maintaining contact information, and understanding the consequences of default.

Accessing Your MPN:

Your MPN should have been provided upon receiving your first federal student loan. You can access it electronically through the Federal Student Aid (FSA) website (https://studentaid.gov/) or request a physical copy by contacting your loan servicer. Don’t hesitate to reach out if you can’t locate your MPN – it’s your key to understanding your loan obligations.

Understanding Your Borrower Rights:

Knowing your rights empowers you to make informed decisions throughout your repayment journey. Let’s dive into some key aspects:

- Deferment and Forbearance: Facing temporary financial hardship, military service, or certain qualifying circumstances? Deferment allows you to temporarily postpone payments, while forbearance offers flexible repayment options. Understand the eligibility requirements and application procedures for each to see if you qualify.

- Repayment Plans and Consolidation: With diverse repayment plans like Standard, Graduated, and Income-Driven options, you can choose the one that best suits your income and expenses. Explore consolidation if you have multiple loans, considering both the benefits and potential impacts on interest accrual.

- Loan Forgiveness Programs: Federal programs like Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness can offer complete or partial loan discharge under specific criteria. Familiarize yourself with the eligibility requirements and application processes to see if you qualify.

- Dispute Resolution: Billing errors, account inconsistencies, or concerns with your loan servicer? You have the right to raise these issues. Learn about the dispute resolution process, contact information for relevant authorities, and available complaint channels.

Fulfilling Your Responsibilities as a Borrower:

With rights come responsibilities. Here are some crucial aspects to remember:

- Timely Repayment and Avoiding Default: Making consistent payments on your loans is paramount. Defaulting can have serious consequences, including damage to your credit score, wage garnishment, and difficulty accessing future financial aid. If facing repayment challenges, seek help early from your loan servicer or reputable organizations.

- Communication and Record-Keeping: Stay informed about any changes to your loan terms or servicer. Maintain accurate records of communication with your servicer, and keep your contact information updated to ensure you receive important notices.

Additional Resources and Support:

Navigating federal student loans doesn’t have to be a solo journey. Leverage the wealth of resources available:

- Federal Student Aid website: Your go-to hub for comprehensive information, tools, and repayment options.

- Consumer Financial Protection Bureau (CFPB) Student Loan Resources: Educational resources and complaint filing options.

- National Foundation for Credit Counseling (NFCC): Non-profit offering free financial counseling and debt management assistance.

- Other government agencies or non-profit organizations: Explore resources specific to your state or educational background.

Remember: Knowledge is power! By understanding your rights and responsibilities as a federal student loan borrower, you can confidently navigate your repayment journey and achieve your financial goals.

Don’t hesitate to seek help from reputable organizations if needed. Take control of your loans and pave the way for a brighter financial future.

What document explains your rights and responsibilities as a federal student loan borrower?

Your Master Promissory Note (MPN) is the key document outlining your rights and responsibilities as a federal student loan borrower. It details the loan terms, including interest rates, repayment period, and fees.

Additionally, it explains your options for deferment, forbearance, and potential forgiveness programs. You can access your MPN electronically through the Federal Student Aid (FSA) website or request a physical copy from your loan servicer.

FAQ’s

What document explains your rights and responsibilities as a federal student loan borrower?

Your Master Promissory Note (MPN) explains your rights and responsibilities as a federal student loan borrower. Think of it as the rulebook for your loan.

What increases your total loan balance?

Several factors can increase your total loan balance:

1. Accruing interest: This is the charge calculated on your outstanding loan balance, even if you’re not making payments. It’s crucial to make at least the minimum payment to prevent interest from snowballing.

2. Unpaid fees: Late payment fees, origination fees, and other charges can add to your overall loan balance.

3. Capitalization of unpaid interest: If you accrue unpaid interest and don’t make payments to cover it, it can be capitalized, meaning it’s added to your principal balance, increasing future interest charges.

What is a forbearance student loan?

Forbearance is a temporary postponement or reduction of your monthly loan payments due to financial hardship, military service, or other qualifying circumstances. It allows you to temporarily pause or lower your payments, but it doesn’t forgive any loan debt. Interest continues to accrue during forbearance, so it’s essential to understand the implications before choosing this option.

Who do you contact if you have questions about repayment plans?

Your loan servicer is the entity responsible for handling your loan payments and processing requests. They can answer your questions about different repayment plans, eligibility, and potential changes to your loan terms. You can find your loan servicer’s contact information on your monthly billing statement or online account.

How can you reduce your total loan cost?

Several strategies can help you reduce your total loan cost:

Choose an income-driven repayment plan: These plans base your monthly payment on your income and family size, potentially lowering your payments and potentially leading to loan forgiveness after 20-25 years of qualified payments.

Make extra payments: Contributing additional funds towards your principal can decrease your loan balance faster and save you money on interest.

Explore loan forgiveness programs: Federal and state programs offer loan forgiveness for specific professions or under certain circumstances. Research and see if you qualify for any of these programs.

When did student loan payments resume?

Federal student loan payments paused in March 2020 due to the COVID-19 pandemic and are scheduled to resume on August 1st, 2023. During this period, interest has not accrued on loans in forbearance. As the restart date approaches, it’s crucial to contact your loan servicer to discuss your repayment options and ensure a smooth transition back to active payments.

Remember, this information is for general understanding and should not be considered financial advice. For personalized guidance, consult a qualified financial professional.